A lending circle is when people get together to form a group loan. Everyone in the group contributes money to the loan, and everyone gets a chance at taking the loan out. People across the world organize loans between friends or family without a financial institution all the time.

This practice is known by many different names across the world: Susus throughout Africa, Paluwagan in the Philippines, Lun-hui in China, and Tandas in Mexico. Participants may not have access to a bank, or may not be a good candidate for a traditional loan, or they may just prefer getting loans from people they know and trust.

How do informal lending circles work?

A small group of people come together, agree on how much they will put into the general fund each month, and they hold each other to it. Let’s say a group of five people agreed to contribute $10 per month for five months, at the end of each month, one person from the group gets $50. You keep going until everyone has had a chance at the $50. This is a popular way for people who don’t have bank accounts, who want to save money, or who can't get approved for mainstream loans to get access to capital. By relying on our neighbors, everyone benefits. These groups have an organizer who makes sure everyone makes their contributions on time, collects the contributions by keeping them somewhere at home or placing them in a private bank account. The organizer also distributes payments to the members and keeps track of whose turn it is to receive a distribution.

Many users come to us with a bad taste

in their mouth from a prior experience with an informal lending circle.

We have heard heartbreaking stories about how one person in the group

walked away with the loan and never repaid it, actually causing everyone

else to lose money. Besides this risk, the other downside to an

informal lending circle is that it doesn’t do anything to build your

credit. While you may be able to get loans from your neighbors, you

still can’t get one from a bank. Without credit, it’s hard to find

apartments, build a business or even get a loan for school.

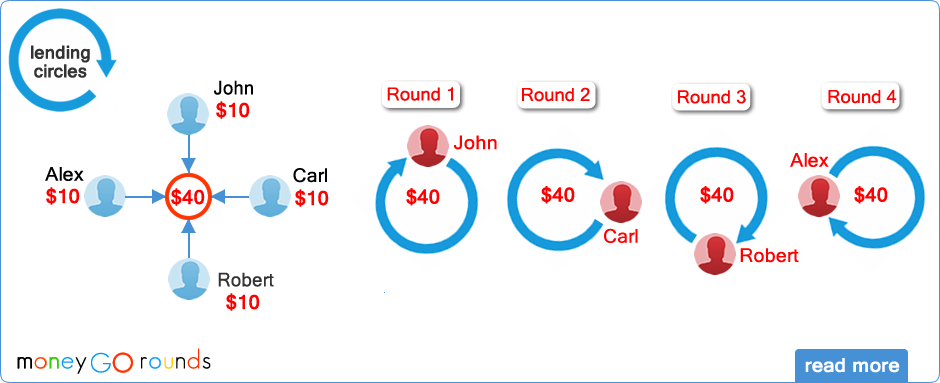

Here’s an example of how it works:

Alex, John, Robert and Carl have a lending circle together and each puts in $100 per month. Each month, they take turns getting $400 until everyone has had a turn. Alex needs $400 to buy equipment for her business. John has supplies for school. Robert has credit card debt she is paying down. And Carl is expecting a tax bill. With financial classes, they can better manage their money and meet financial goals.

Every time they make a payment on time, it’s reported to the credit bureau. The result? Everyone gets and pays back a loan of $400 over the four months. And all the participants see an average credit score increase of 49 points in just six months.

A Lending Circle (Rotating Saving Group)

is an informal association of participants who make regular

contributions to a common fund which is given in whole or in part to

each contributor in turn. Members of a Rotating Saving Group may decide

to contribute the pre-determined sum every day, week or month. During

each round, the pot is given to one member.

Once a member has

received the collected money, he must continue to contribute but will

not receive the lump sum until all the members have had a chance to

receive it once. When the last member has received the lump sum, the

group may decide to start a new cycle.

At each round all the

member of the Saving Group contributes $100, during the first round John

will receive the pot. During the second round the pot will go to Carl,

Robert will receive the pot during the third round and Alex during the

fourth round.

At each meeting the money is collected and given to

one member by using your PayPal account. Once a member has received the

collected money, he must continue to contribute but will not receive the

lump sum until all the members have had a chance to receive it once.