The idea behind social saving is that the more support you get in working towards your goals (especially in saving money) the more successful you can be. In general, that’s a good argument: I know that I’m more likely to complete a goal if someone will hold me accountable for it. In terms of goal-setting, accountability does not need to be formal — just the fact that someone knows about my goal and will think poorly about me if I don’t complete it is enough to encourage me. It’s a relatively simple hack that can really increase your ability to move forward on your goals. That holds true for monetary goals just as much as any other ambition.

The benefit of having a checking account for daily expenses and a savings account for emergency funds is that the separate accounts provide a barrier preventing you from accidentally spending money that should go to funding your future. Goal-setting accounts work the same way.

A goal-oriented account allows a consumer to set a specific financial target, figure out how long it will take to reach that target and slowly sock away money in an account far away from the temptations of everyday spending. They are available in three varieties — registries, savings accounts, and subaccounts joined to a regular savings account or checking account.

“Goal-setting accounts basically just help you get organized and stay on track,” says Jon Gaskell, co-founder of SmartyPig.com, a site that allows consumers to set up free savings accounts for goals ranging from honeymoons to holiday savings. The accounts are insured by the Federal Deposit Insurance Corp. “There is hard data that suggests that putting pen to paper and saying, ‘I’m going to lose 10 pounds,’ gives you a much better shot of achieving that goal. Why can’t that work for your finances?”

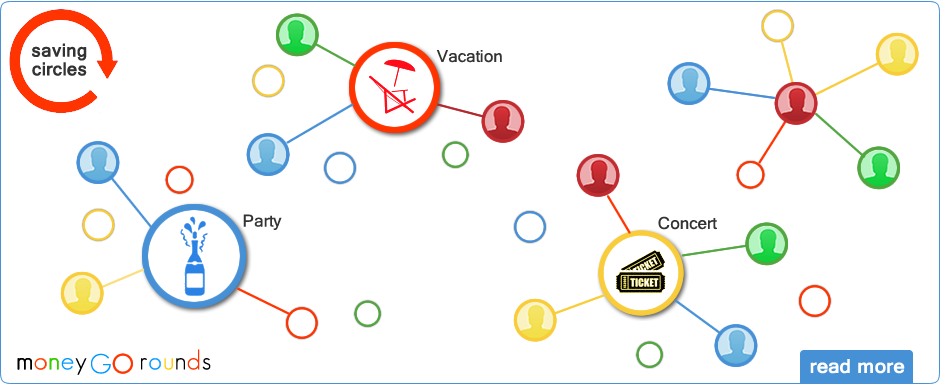

Create a Saving Circle and allows friends and family to contribute to your savings goal, in this case a mortgage down payment.

Whether a goal-oriented savings account is right for you depends on how much you plan to save and how long it will take to do it. Goal-setting savings accounts are designed for short- and medium-term goals, not long-term projects like retirement or college savings. If you are saving more than a few thousand dollars or for longer than a year or two, you would get greater benefit from a higher-interest savings instrument such as a Treasury bond or certificate of deposit.

About precommitment and saving

Just use goal visualization, social commitments, and mobile and online technology to help consumers quantify and enjoy the act of not buying. Research shows that impulse buying provides momentary satisfaction, but hinders savings efforts and contributes to debt. The goal of the Piggymojo project is to help low‐income earners increase their savings by motivating and enabling them to make ‘impulse saves’ that retain the satisfaction element of impulse buying without the financial costs. This project will integrate the Piggymojo solution with Brooklyn Cooperative’s core platform so that the impulse save results in money actually moving from the user’s checking account into a savings account. Evaluation partner Center for Community Capital at University of North Carolina-Chapel Hill will study how Piggymojo promotes the financial capability of Brooklyn Cooperative members.

Our mission is to help people save money

by quantifying opportunities to avoid spending and to strengthen the

connection between spending avoidance and savings.